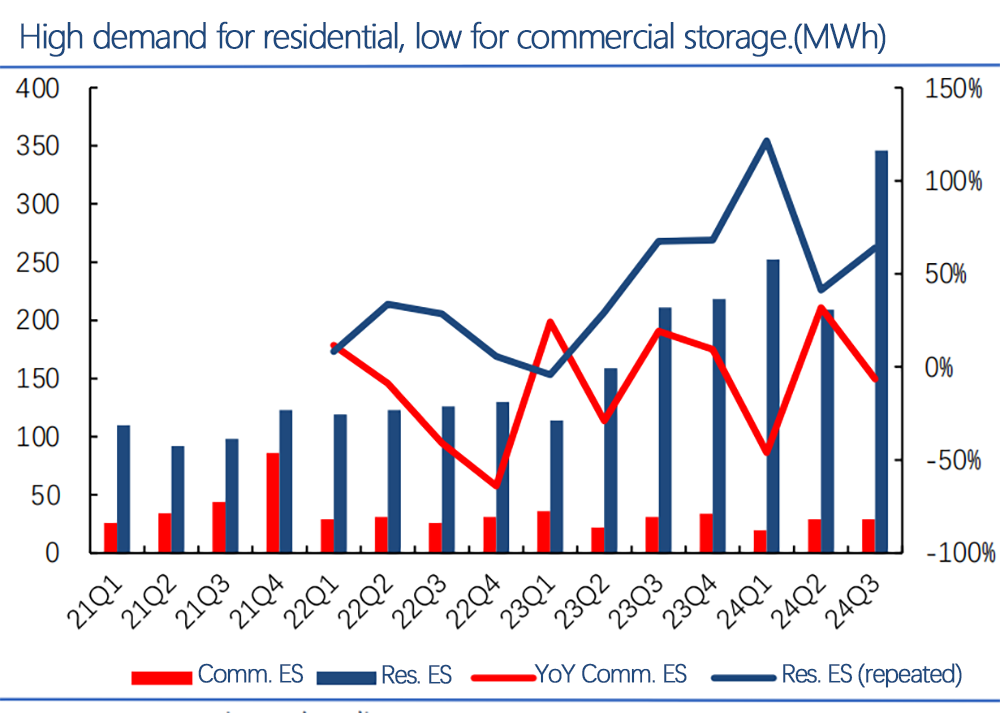

The US residential energy storage market (blue bars) has grown rapidly, from just a few MWh per quarter in 2021 to over 300 MWh per quarter by 2024. Growth has stayed between 50%-100% year-on-year. In contrast, commercial storage (red bars) remains smaller and more volatile.

Key points from recent reports (Wood Mackenzie, SEIA, etc.):

Installed Capacity: Residential storage reached nearly 3 GWh by mid-2024, with expectations to exceed 5 GWh by year-end.

Penetration: States like California, Texas, and Florida have 10%-15% household storage penetration, which could increase due to power outages and extreme weather.

Policy Incentives: Federal tax credits (30%+ ITC) and state subsidies, like California’s SGIP, enhance residential storage economics.

Business Models: Leasing, PPAs, and financing options reduce upfront costs, easing the adoption of residential storage.

The rapid growth in residential storage is driven by high demand, favorable policies, and declining costs. Commercial storage, though still small and more complex, has long-term potential for peak demand management and grid services.

Overall, residential storage is expected to keep growing at a strong pace, potentially reaching 8-10 GWh by 2025.

Post time: Jan-16-2025